Sent: Wednesday, February 22, 2012 10:37 AM

from: george.hartzman@wellsfargoadvisors.com to: aaron.l.landry@wellsfargoadvisors.com, danny.ludeman@wellsfargoadvisors.com, john.g.stumpf@wellsfargo.com, d.carroll@wellsfargo.com, stacey.mitchell@wellsfargoadvisors.com, don.geczi@wellsfargoadvisors.com, baconmij@wellsfargo.com, bill.rogers@wellsfargoadvisors.com, doug.lowe@wellsfargoadvisors.com, BoardCommunications@wellsfargo.com, karl.f.riem@wellsfargo.com, Grant.Carlson@wellsfargo.com, Bruce.J.Berrol@wellsfargo.com

Attachments; 10k.doc

.

.

“LIQUIDITY AND FUNDING

Asset liquidity is further enhanced by our ability to sell or securitize loans in secondary markets and to pledge loans to access secured borrowing facilities through the Federal Home Loan Banks, the Federal Reserve Board, or the U.S. Treasury.

[Ability doesn't mean borrowed]

Short-term borrowings averaged $65.8 billion in 2008 and $25.9 billion in 2007, an increase of $39.9 billion due to business funding needs.”

Wells Fargo 2008 10k

[no mention of FED TAF loans or Discount Window borrowing]

.

.

Falsification of any company…information that you provide is prohibited.

Falsification refers to knowingly misstating, altering, adding information to, or omitting or deleting information …which results in something that is untrue, fraudulent, or misleading.

Wells Fargo’s Code of Ethics and Business Conduct

.

.

“Asset liquidity is further enhanced by our ability to sell or securitize loans in secondary markets and to pledge loans to access secured borrowing facilities through the Federal Home Loan Banks, the FRB, or the U.S. Treasury.

Short-term borrowings averaged $52.0 billion in 2009 and $65.8 billion in 2008.

We reduced short-term borrowings due to the continued liquidation of previously identified non-strategic and liquidating loan portfolios, soft loan demand and strong deposit growth.”

2009 10k

[no mention of FED TAF loans or Discount Window borrowing]

.

.

Short-Term Borrowings

2007: 53,255.0

2008: 108,074.0

2009: 38,966.0

2010: 55,401.0

[no mention of FED TAF loans or Discount Window borrowing]

.

.

Sarbanes–Oxley Act

...mandates that senior executives take individual responsibility for the accuracy and completeness of corporate financial reports.

...Section 302 requires that the company's "principal officers" (typically the Chief Executive Officer and Chief Financial Officer) certify and approve the integrity of their company financial reports quarterly.

Title IV ...requires timely reporting of material changes in financial condition...

Sarbanes-Oxley required the disclosure of all material off-balance sheet items.

It ...specifies the responsibility of corporate officers for the accuracy and validity of corporate financial reports.

...The CEO and CFO are now required to unequivocally take ownership for their financial statements under Section 302…

Title IV ...requires timely reporting of material changes in financial condition...

Sarbanes-Oxley required the disclosure of all material off-balance sheet items.

Wikipedia

.

.

The Audit and Examination Committee of the Wells Fargo & Company Board of Directors will oversee the investigation of concerns raised about accounting, internal accounting controls, and auditing matters.

Wells Fargo’s Code of Ethics and Business Conduct

.

.

The Audit and Examination Committee is a standing audit committee of the Board of Directors established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934.

The Committee has eight members: John D. Baker II, Lloyd H. Dean, Enrique Hernandez, Jr., Robert L. Joss, Cynthia H. Milligan, Nicholas G. Moore, Philip J. Quigley and Susan G. Swenson.

.

.

C. Insider Trading

Insider trading involves the purchase or sale of securities of a company or other entity while in possession of material, nonpublic information (also called “inside information”) about the company or entity.

1. Material Inside Information - “Inside” or “nonpublic information” is information about a business organization that is not generally available to or known by the public.

Such information is considered to be “material” if there is a likelihood that it would be considered important by an investor in making a decision to buy or sell a company’s securities…

Director Code of Ethics

Wells Fargo & Company

.

.

Information should be presumed “material” if it relates to, among other things, any of the following:

• significant gains or losses; • significant merger or acquisition proposals or agreements; • significant purchase or sale of assets; • significant borrowing; • new debt or equity offerings; • liquidity problems...

Director Code of Ethics

Wells Fargo & Company

.

.

Board members must avoid conflicts of interest or the appearance of conflicts of interest in their activities.

A conflict of interest is a situation in which a director’s personal interest or outside economic interest in a matter:

• may be inconsistent or incompatible with the director’s obligation to exercise his or her best judgment in pursuit of the interests of Wells Fargo; • results in an improper personal benefit to such director as a result of his or her position with Wells Fargo; or

• raises a reasonable question about or the appearance of such interference, inconsistency, or improper personal benefit.

.

.

Wells Fargo Fourth Quarter 2008:

• Successfully closed Wachovia acquisition on December 31, 2008

Significantly reduced the risk, or “de-risked,” the balance sheet and future earnings stream of the new Wells Fargo

…• Wachovia period-end loans, securities, trading assets and loans held for sale reduced by $115.2 billion, or 17 percent, from June 30, 2008

• No plans to request additional TARP capital

[no mention of FED TAF loans or Discount Window borrowing]

• Fourth quarter net loss of $2.55 billion, or $0.79 per share, included the following significant

items: $(5.6) billion, or $(0.99) per share, credit reserve build through Wells Fargo earnings, which

includes $(3.9) billion, or $(0.69) per share, to conform reserve practices of both Wells Fargo

and Wachovia

[no mention of FED TAF loans or Discount Window borrowing]

...The decline in profitability was caused by adding $8.1 billion to credit Reserves…

[no mention of FED TAF loans or Discount Window borrowing]

The fundamentals of our time-tested business model, however, are as sound as ever.

[inaccurate and misleading]

[no mention of FED TAF loans or Discount Window borrowing]

…our company at year-end 2008 was one of the world’s strongest financial

institutions.”

[inaccurate and misleading]

[no mention of FED TAF loans or Discount Window borrowing]

https://www.wellsfargo.com/pdf/press/4q08pr.pdf

.

.

Ethics

We strive for the highest ethical standards with team members, customers, our communities and shareholders.

Honesty, trust and integrity are essential for meeting the highest standards of corporate governance.

They’re not just the responsibility of our senior leaders and our board of directors.

We’re all responsible.

All 275,000 of us.

Corporations don’t have a conscience.

People do.

Our ethics are the sum of all the decisions each of us makes every day.

If you want to find out how strong a company’s ethics are, don’t listen to what its people say.

Watch what they do.

This is even more important in our industry because everything we do is built on trust.

…They trust our financial consultants to give them the right financial advice.

..We behave ethically when we:

•Value and reward open, honest, two-way communication.

•Hold ourselves accountable for, and are proud of, our decisions and our conduct.

•Only make promises we intend to keep—do what we say we’ll do.

If things change, let people know.

•Share information with our colleagues that they need, and let them know if things change.

•Avoid any actual or perceived conflict of interest.

•Comply with the letter and the spirit of the law.

•Acknowledge and apologize for our mistakes, and learn from our errors so we don’t make them again.

We want compliance and risk management to be part of our culture, an extension of our code of ethics.

Everyone shapes the risk culture of our company.

We encourage all team members to identify and bring risk forward.

We should thank them for doing so, not penalize them.

Ben Franklin was right: An ounce of prevention is worth a pound of cure.

We value what’s right for our customers in everything we do.

…Our customers—external and internal—are our friends.

We advocate for their best financial interests.

…We put their long-term financial interests first by: •Starting every discussion with what’s best for them.

https://www.wellsfargo.com/invest_relations/vision_values/6

.

.

Ethics Committee Review

If a disclosure, request for approval, or exception request arises that is not discussed in the Code, or if application of the rule to a set of circumstances is unclear or has broad policy implications, the Code Administrator or member of the Operating Committee who initially received the request or disclosure may forward the documentation to the corporate secretary, care of Wells Fargo Legal Group, for referral to and resolution by the Ethics Committee.

[Code administrators above received this email]

The corporate secretary or the Ethics Committee will notify the Code Administrator and the Operating Committee member of the Ethics Committee’s decision.

A copy of each disclosure or request, noting the approval or disapproval by the Ethics Committee, must be returned to the team member and a copy, with the team member’s Employee ID included, shall be forwarded to Employee Records for placement in the team member’s official personnel file.

[I received nothing but formal warnings]

[Did my case ever get to the Ethics Committee?]

All disclosures, requests for approval or consent, requests for exceptions, and other Code documentation must be retained in the team member’s official personnel file.

https://www.wellsfargo.com/downloads/pdf/about/team_member_code_of_ethics.pdf

.

.

"Prudent Man Rule – A fiduciary must act “with the care, skill, prudence and diligence under the circumstances then prevailing that a prudent man acting in a like capacity” would act.

This rule is derived from the common law of trusts.

This is an objective standard based upon how a person with experience and knowledge of a certain area would act in a given situation."

29 U.S.C. §1104 (a)(1)(B).

.

.

...Wells Fargo expects its team members to adhere to the highest possible standards of ethics and business conduct with customers, team members, vendors, stockholders, other investors, and the communities it serves and to comply with all applicable laws, rules, and regulations that govern our businesses.

The Audit and Examination Committee of the Wells Fargo & Company Board of Directors will oversee the investigation of concerns raised about accounting, internal accounting controls, and auditing matters.

Wells Fargo’s Code of Ethics and Business Conduct

[Did the Audit and Examination Committee of the Board oversee Brian Mixdorf's investigation?]

.

.

Were the reports accurate?

Was this information disclosed?

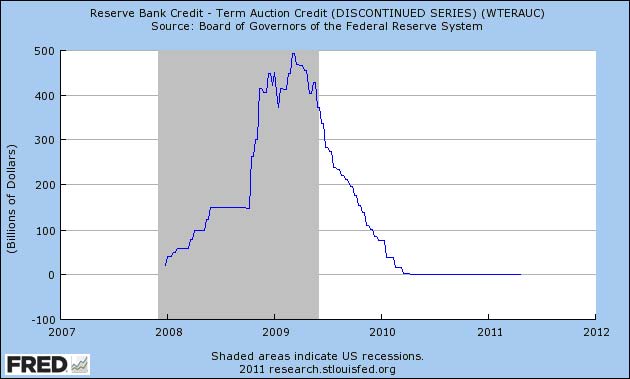

http://www.bloomberg.com/data-visualization/federal-reserve-emergency-lending/#/compare/?comparelist=Wachovia_Corp-Wells_Fargo_%2526_Co

If it is my responsibility to raise concerns and nothing happens, what is my responsibility to whom after?

Is this a usual response for those who stick their necks out?

Should one who raises concerns be informed of the investigative outcome?

.

.

Misprision of felony was an offence under the common law of England…

It consisted of failing to report knowledge of a felony to the appropriate authorities.

A person was not obliged to disclose his knowledge of a felony where the disclosure would tend to incriminate him of that offence or another.

…generally only applied against persons placed in a special position of authority or responsibility.

In this case, the offence of misfeasance in public office or malfeasance in public office may be considered instead.

For example, corrections officers who stand idly by while drug trafficking occurs within the prison

may be prosecuted for this crime.

United States federal law

"Misprision of felony" is still an offense under United States federal law after being codified in 1909 under 18 U.S.C. § 4:

Whoever, having knowledge of the actual commission of a felony cognizable by a court of the United States, conceals and does not as soon as possible make known the same to some judge or other person in civil or military authority under the United States, shall be fined under this title or imprisoned not more than three years, or both.

This offense, however, requires active concealment of a known felony rather than merely failing to report it.

Wiki

Misprision of felony From the U.S. Code Online via GPO Access

TITLE 18–CRIMES AND CRIMINAL PROCEDURE PART I–CRIMES CHAPTER 1–GENERAL PROVISIONS

Sec. 4. Misprision of felony

Whoever, having knowledge of the actual commission of a felony cognizable by a court of the United States, conceals and does not as soon as possible make known the same to some judge or other person in civil or military authority under the United States, shall be fined under this title or imprisoned not more than three years, or both.

.

.

Insider Holders

Individual/Entity Most Recent Trans. Shares Owned as of Trans. Date

STEEL ROBERT KING

Director Acquisition (Non Open Market)

Apr 27, 2010 601,903

STUMPF JOHN G

Officer Acquisition (Non Open Market)

Dec 14, 2011 252,163

ATKINS HOWARD I

Officer Option Exercise

Dec 31, 2010 271,873

No comments:

Post a Comment