|

| http://cfgg.org/wp-content/uploads/2013/05/CFGG-2013AnnualReport.pdf |

If the money is safe for the GPAC guarantee, how did the CFGG make 14.7% on its assets in 2013?

What is the Foundation’s investment objective?

The overall, long-term investment objective of the Community Foundation is to achieve an annualized total return through appreciation and income (net of investment management fees and expenses) that is greater than the rate of inflation (as measured by the broad, domestic Consumer Price Index) plus 6%, which protects fund assets against inflation.

How are funds invested and managed?

The Community Foundation Investment Committee works with the Funds Evaluation Group (FEG) of Cincinnati, Ohio, for investment management and oversight of our portfolio.

|

| Add caption |

$73,876,854 / $116,422,059 = 63.45% of the money is in stocks?

|

| http://cfgg.org/wp-content/uploads/2013/05/CFGG-2012-audited-financial-statements.pdf |

The only asset guaranteed above is US government obligations.

|

| http://cfgg.org/wp-content/uploads/2013/05/CFGG-2012-audited-financial-statements.pdf |

Who owes the CFGG almost $15 million?

|

| http://cfgg.org/wp-content/uploads/2013/05/CFGG-2012-audited-financial-statements.pdf |

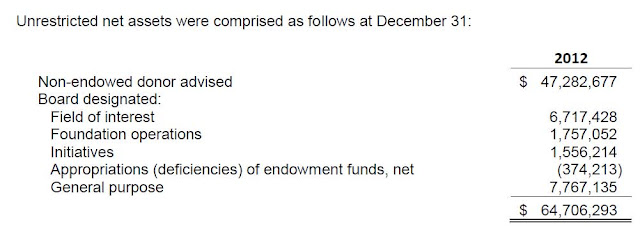

Can the CFGG pledge Non-endowed, donor advised assets to the GPAC project?

.

.

The financial statement states "Temporarily restricted net assets are those assets or earnings on assets which have been donated with donor imposed time or purpose restrictions. When a stipulated time restriction expires or purpose restriction is accomplished, temporarily restricted net assets are reclassified to unrestricted net assets and reported in the combined statements of activities as net assets released from restrictions."

$146,347,903 total "assets" - $26,376,860 liabilities - $28,506,950 permanently restricted = $91,464,093 - $26,757,800 temporarily restricted = $64, 706,293 to guarantee $30,000,000 and continue to pay out $11.5 million in annual charitable grants while paying principal and interest payments on a government subsidized project by an organization that's supposed to "promote philanthropy by addressing emerging community issues"?

Is the GPAC considered an emerging community issue?

|

| http://cfgg.org/wp-content/uploads/2013/05/CFGG-2012-audited-financial-statements.pdf |

If the CCFG's assets are at risk of rising and falling with financial markets, how can they guarantee the money to Greensboro's taxpayers, even with a bank provided letter of credit?

|

| http://cfgg.org/wp-content/uploads/2013/05/CFGG-2012-audited-financial-statements.pdf |

Looks like "unconditional" pledges receivable may be uncollectible.

"What types of charities can receive grants?

Grants awarded through funds at The Community Foundation must be made to organizations with official 501(c)(3) status.

Tax Status - The Community Foundation of Greater Greensboro, Inc. and its supporting organizations are exempt from income tax, under Section 501(c)(3) of the Internal Revenue Code, except for unrelated business income tax. Contributions to the Community Foundation are tax deductible by the donor."

If the City of Greensboro is going to own the GPAC, how are the donations tax deductible, and how is CFGG's money going to end up at the city, if CFGG isn't allowed to give money to anyone other than a 501(c)(3)?

.

.

Also of interest from the financial statement; "A real estate limited liability corporation (“LLC”), which is included in the Community Foundation's combined financial statements as a supporting organization, owns approximately 20% of Center City Park's land in downtown Greensboro. The other approximate 80% of land is owned by another local nonprofit organization. Center City Park is operated by a third, unrelated nonprofit organization."

.

.

$1,595,111 / $64,706,293 = 2.46% charge per year to manage the assets?

Previously;

On GPAC and the Community Foundation

1 comment:

George:

Very interesting read.

A passing observation arises: any foundation, no matter how prudently managed, now and in the future, has no ability to “guarantee”. Meaning, a promise of-sorts, is merely that; a promise of- sorts. No guarantee implied.

Post a Comment